Introduction

In the rapidly evolving world of finance, innovative concepts are constantly emerging to disrupt traditional lending systems. Flashloans have gained significant attention as an exciting and potentially lucrative financial tool. In this article, we will delve into the depths of flashloans, exploring how they work and the various ways you can make money from them. Whether you are an experienced investor or a curious individual seeking to explore new opportunities, this comprehensive guide will equip you with the knowledge you need to leverage flashloans effectively. So, let’s get started!

What is a Flashloan?

A flashloan is a unique feature offered by some decentralized finance (DeFi) platforms that allows users to borrow a specific amount of cryptocurrency without requiring any collateral. The borrowed funds are instantly available and can be used for various purposes within a single transaction. However, the borrowed amount must be returned, along with the transaction fees, within the same transaction block. This immediate repayment requirement ensures the security and integrity of the flashloan mechanism.

How Do Flashloans Work?

Flashloans leverage the power of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts reside on blockchain networks, such as Ethereum, and enable the execution of complex financial transactions.

When a user initiates a flashloan, the smart contract verifies if the borrowed amount can be repaid within the same transaction. If the repayment is not possible, the entire transaction is automatically reversed, ensuring the lender does not face any risk. This mechanism prevents fraudulent activities and ensures the security of the lending protocol.

The Benefits of Flashloans

Flashloans offer several advantages that make them an attractive option for both borrowers and investors:

- Instant Access: Flashloans provide immediate access to funds without any collateral requirements, offering a level of flexibility and convenience unparalleled in traditional lending systems.

- Capital Efficiency: By utilizing flashloans, investors can maximize their capital utilization and engage in multiple transactions within a single block, unlocking new opportunities for profit.

- Global Accessibility: Flashloans are accessible to anyone with an internet connection, allowing individuals from all over the world to participate in decentralized finance and profit from their transactions.

- High Potential Returns: With the right strategies and market conditions, flashloans can generate substantial profits through various trading and investment opportunities.

Making Money with Flashloans: Strategies and Steps

Strategy 1: Arbitrage Trading

Arbitrage trading involves exploiting price differences for the same asset across different exchanges or platforms. Flashloans enable traders to quickly borrow funds, execute profitable trades, and repay the loan within the same transaction. This strategy capitalizes on temporary market inefficiencies, generating profits through swift and strategic trading moves.

Strategy 2: Liquidity Provision

Flashloans can also be utilized for liquidity provision in decentralized exchanges (DEXs). By providing liquidity to pools, users earn transaction fees and other incentives. Flashloans allow for the rapid movement of funds between exchanges, enabling liquidity providers to capitalize on opportunities and maximize their earnings.

Strategy 3: Yield Farming

Yield farming involves staking or providing liquidity to decentralized finance protocols in exchange for high annual percentage yields (APYs) and additional tokens. Flashloans can be used to optimize yield farming strategies by swiftly moving funds between protocols to capture the most favorable returns.

Strategy 4: DeFi Token Trading

Flashloans can be leveraged to engage in high-frequency trading of DeFi tokens. Traders can take advantage of short-term price fluctuations and execute profitable trades within a single block. This strategy requires in-depth market analysis and swift execution to maximize returns.

Flashloan Bot: Automating Borrowing and Lending

Flashloan bots have become an integral part of the DeFi ecosystem. These automated programs interact with flashloan-enabled platforms and execute a series of predefined operations to exploit profitable opportunities. By leveraging flashloans, these bots can participate in various strategies, including arbitrage, yield farming, and liquidation hunting, to generate profits.

Aave Flashloan: Unleashing DeFi’s Power

Aave, one of the leading DeFi protocols, offers a robust flashloan feature. With Aave flashloans, users can borrow a wide range of cryptocurrencies instantly and without collateral. The platform’s extensive liquidity and diverse market coverage make it a popular choice among flashloan enthusiasts. Furthermore, Aave allows borrowers to take advantage of unique features like stable interest rates and customizable borrowing terms.

Flashloan Arbitrage: Profiting from Price Inefficiencies

Flashloan arbitrage involves exploiting price differences between different cryptocurrency exchanges or liquidity pools. Traders can use flashloans to quickly borrow a substantial amount of funds and execute profitable trades within a single transaction. This strategy capitalizes on temporary price inefficiencies and can yield significant returns if executed effectively.

Dydx Flashloan: Empowering Users with Non-Custodial Borrowing

Dydx is another prominent DeFi platform that supports flashloans. What sets Dydx apart is its focus on non-custodial borrowing and lending. Users can access flashloans on Dydx without the need for intermediaries, ensuring a higher level of security and control over their funds. This decentralized approach aligns with the core principles of blockchain technology.

BSC Flashloan: Bridging Liquidity on the Binance Smart Chain

The Binance Smart Chain (BSC) has emerged as a popular alternative to Ethereum due to its low transaction fees and high throughput. Flashloans on the BSC enable users to leverage the chain’s liquidity for various purposes, such as trading, yield farming, and collateral swaps. BSC flashloans have contributed to the growth of decentralized finance by expanding access to affordable and instant liquidity.

Aave Flashloan Fee: Exploring the Costs of Instant Liquidity

While flashloans provide unparalleled flexibility and accessibility, they do come with fees. Aave charges a small fee on flashloans, typically calculated as a percentage of the borrowed amount. This fee helps maintain the security and sustainability of the protocol while ensuring the availability of flashloan services to the broader community.

Flashloan Arbitrage Bot: Automated Profit-Making Strategies

Flashloan arbitrage bots have gained popularity in the cryptocurrency space for their ability to automate profitable trading strategies. These bots utilize flashloans to execute a sequence of trades across multiple platforms, taking advantage of price differentials and generating profits within a single transaction. Flashloan arbitrage bots require advanced programming and careful strategy implementation to be effective.

Flashloan Aave: Leveraging Aave’s Lending and Borrowing Protocol

Aave’s lending and borrowing protocol offers a wide range of flashloan opportunities. Users can borrow funds from Aave’s extensive pool of liquidity and employ them for various purposes, such as refinancing debt, funding investments, or participating in yield farming strategies. The versatility of Aave’s flashloan feature makes it an attractive choice for both beginners and experienced DeFi enthusiasts.

Understanding Flashloans: How They Work

Flashloans rely on the unique properties of blockchain technology and smart contracts. When a user requests a flashloan, the smart contract verifies if the requested amount can be borrowed and if the transaction can be executed within a single block. If the conditions are met, the funds are transferred to the borrower, who can then utilize them within the same transaction. Upon repayment, including the loan amount and fees, the transaction is considered complete.

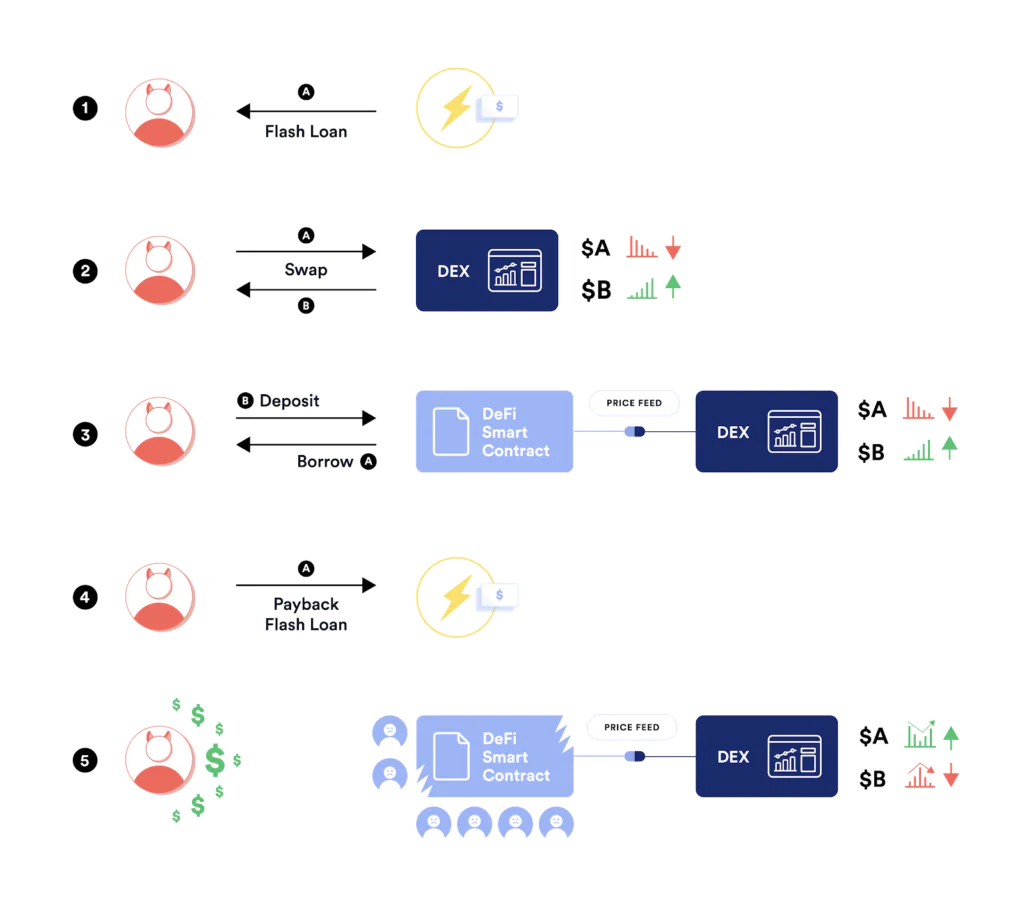

Flashloan Attack: Vulnerabilities and Security Considerations

Flashloans have faced instances of vulnerabilities and attacks within the DeFi ecosystem. These attacks exploit weaknesses in smart contracts or manipulate market conditions to gain unfair advantages. Security-conscious users must carefully assess the risks associated with flashloans and ensure they interact with trusted platforms and protocols to mitigate potential vulnerabilities.

Aave Flashloan Example: Illustrating the Process

To better understand how flashloans work in practice, let’s consider an example using Aave. Suppose Alice wants to participate in a liquidity mining program but lacks the necessary funds. She can utilize an Aave flashloan to borrow the required amount, deploy it to the liquidity mining pool, earn rewards, repay the flashloan, and keep the profits generated. This example demonstrates the power of flashloans in enabling users to engage in various DeFi activities without significant upfront capital.

Flashloan Providers: Platforms and Protocols

Flashloan services are offered by several platforms and protocols in the DeFi space. Apart from Aave and Dydx, other notable providers include Furucombo, Compound, and Balancer. Each platform has its unique features, borrowing terms, and supported cryptocurrencies. Users should explore different options and select a provider that aligns with their specific requirements and risk appetite.

Flashloan Solidity: Smart Contract Development with Flashloans

Solidity, the programming language for Ethereum smart contracts, plays a crucial role in flashloan implementation. Developers can utilize Solidity to create smart contracts that incorporate flashloan functionality. By leveraging Solidity’s capabilities, developers can design secure and efficient smart contracts that enable users to access flashloan services and build innovative decentralized applications.

Flashloan Solana: Harnessing Speed and Efficiency

Solana, a high-performance blockchain platform, has also embraced the concept of flashloans. Flashloans on Solana leverage the network’s fast transaction processing and low fees, enabling users to access instant liquidity with minimal overhead costs. Solana’s scalability and throughput make it an attractive choice for those seeking efficient flashloan services in a rapidly evolving DeFi landscape.

Risks and Considerations

While flashloans offer lucrative opportunities, it is crucial to understand and manage the associated risks. Some key considerations include:

- Smart Contract Risks: Flashloans are reliant on the security and reliability of smart contracts. Any vulnerabilities or bugs in the code can be exploited by malicious actors. Therefore, it is essential to thoroughly research and select reputable lending platforms.

- Market Volatility: The cryptocurrency market is highly volatile, and flashloan strategies are susceptible to rapid price fluctuations. Traders must carefully assess the risks and set appropriate risk management measures.

- Transaction Reversals: Flashloans can be reversed if the borrowed amount cannot be repaid within the same transaction. Traders must ensure they have a solid strategy in place to mitigate this risk.

Conclusion

Flashloans have revolutionized the way liquidity is accessed and utilized within the cryptocurrency ecosystem. These innovative financial instruments empower users with instant capital and open up countless opportunities for profit-making strategies. However, it is essential to exercise caution and understand the risks associated with flashloans. By staying informed and leveraging trusted platforms and protocols, individuals can navigate the world of flashloans and explore their full potential.

Frequently Asked Questions (FAQs)

- Q: How can I make money with flashloans? A: Flashloans offer opportunities for profit through strategies like arbitrage, yield farming, and liquidity provision. By capitalizing on price inefficiencies and leveraging flashloan services, individuals can generate profits within a single transaction.

- Q: Are flashloans secure? A: Flashloans carry certain risks, primarily related to smart contract vulnerabilities and market conditions. It is crucial to use reputable platforms and exercise due diligence to mitigate potential security concerns.

- Q: Which platforms offer flashloan services? A: Several platforms and protocols provide flashloan services, including Aave, Dydx, Furucombo, Compound, and Balancer. Each platform has its unique features and borrowing terms, so users should explore different options before engaging in flashloan activities.

- Q: Can I borrow any cryptocurrency with flashloans? A: The availability of flashloan-enabled cryptocurrencies varies across platforms. It is important to check the supported assets on each platform to determine which cryptocurrencies can be borrowed.

- Q: What are the fees associated with flashloans? A: Flashloans typically involve fees that are calculated as a percentage of the borrowed amount. These fees contribute to the sustainability and security of the flashloan ecosystem.

- Q: What is the minimum capital required to engage in flashloan transactions? A: The minimum capital required for flashloan transactions varies depending on the lending platform and the specific asset being borrowed. However, it is generally recommended to have a sufficient amount of capital to cover potential losses and transaction fees.

- Q: Can anyone access flashloans? A: Yes, flashloans are accessible to anyone with an internet connection and a compatible digital wallet. However, it is essential to comply with any regulatory requirements imposed by the lending platform.

- Q: Are there any legal implications associated with flashloans? A: The legal implications of flashloans vary across jurisdictions. It is crucial to familiarize yourself with the legal and regulatory framework in your country or region to ensure compliance.

- Q: How do flashloans impact the overall stability of the DeFi ecosystem? A: Flashloans contribute to the growth and innovation of the DeFi ecosystem by providing liquidity, enabling new trading strategies, and facilitating the efficient movement of funds. However, excessive reliance on flashloans can introduce

volatility and potentially destabilize the market if not used responsibly.

Resources:

- Aave Documentation: https://docs.aave.com/

- dYdX Documentation: https://docs.dydx.exchange/

- Binance Smart Chain: https://www.binance.org/

- Solana Documentation: https://docs.solana.com/

- Flashloan Security: https://medium.com/@peckshield/analysis-on-flash-loan-and-its-security-concerns-afb21e04b9f4

- Flashloan Exploit Example: https://coinmarketcap.com/alexandria/article/what-are-flash-loan-attacks

- Flashloan Solidity Example: https://github.com/aave/flashloan-box

- GitHub Flashloan Repositories: https://github.com/search?q=flashloan

Disclaimer: The resources provided above are for informational purposes only. Use them at your own discretion.

Read more – Top 10 Blockchain Startup Ideas 2023: Exploring Profitable Opportunities in the Web3 Era

Read more – ZkSync Airdrop 2023 : Guide to Participating

Read more – The Rise of DeFi 2023: Revolutionizing the Financial Landscape Decentralized Finance

1 thought on “Flashloan 2023: A Comprehensive Guide to Making Money”